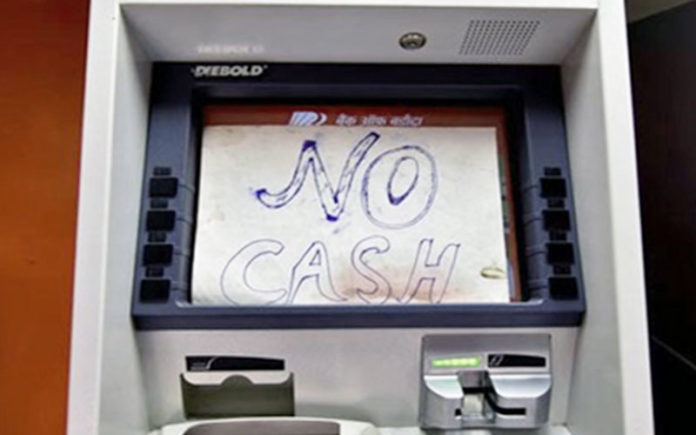

6 ways to beat the cash crunch

With the country getting Cash-devoid in the ATMs, there are many who have had a sour experience in tackling its adamancy.

Pritam Chandak, a resident of Mumbai clamored that due to the present cashless scenario, he was unable to pay his accountancy course fees, which he later had to borrow from his friends.

Even Andhra Pradesh, Rajasthan, Madhya Pradesh and many others encountered the similar helpless situation, where the people claimed to have run pillar to post with a hope of receiving the cash at some or the other ATMs but failed.

Repeating the past of the demonetization phase, this also though being temporary, has caused an akin commotion in the country.

Further, according to the sources, a senior bank sector official was quoted as saying “ATM managed service providers (MSPs) have not been paid for re-calibrating the ATMs after demonetisation. So when the new 200 rupee note came into circulation, many MSPs refused to re-calibrate the ATMs further. Banks see this as a decision of the government and are waiting to get reimbursed by the government in order to pay the MSPs. This has led to a shortage of lower denomination notes. This is one of the reasons why ATMs are facing a cash crunch”.

Although, the centre has plunged into the issue and has revealed that the issue has been looked after and it will take some time for the new notes to be printed, yet there has to be doing something in order to woo away the “priceless” agony!

So, here are SIX ways to beat the cash crunch:

Net Banking, Mobile wallets

Ever since its advent and launch, it has always been a soul-saver. Soft cash is always one of the best replacements for the hard cash. One can do everything and anything, if accessible, with hardly any hitch in its usage.Name it and just with a click, you can have it.

Unified Payments Interface

The multiple steps net banking transfer can be blissfully curbed by Unified Payment Interface(UPI). It beholds an amazing feature of immediate bank accounts to accounts transfer. This is accessible through either downloading the bank mobile phone app by first checking if your particular bank supports UPI payment processing or simply download BMIH app from the mobile play store.

Debit/ Credit cards

These cards always add up to the browny point, in case of any emergency. The only thing to do is just swipe out your card and Woohhoo!your transaction is complete. Although, many prefer accumulating the bonus points on their credit cards so that they can spend more, yet these cards can are a life- saviour!

Cheques

This has always been the way to pay out the salaries or any heavy payments. It is due to the Jan Dhan accounts, that the country’s non-account holders too now have a bank account.

“Pay your local service provider (driver, maid, newspaper vendor and grocer) online and educate at least one person to either use an e-wallet or opening a bank account for long-term benefit”, quotes Joshi.

Cash at home

This can always work when the ATMs run dry as maintaining a little balance in hand at home can always come in handy during the emergencies.

Self-addressed cheques

Money can also be easily received from your nearby bank branches, by signing a self-addressed cheque and receiving the payment in return.