The online gaming industry in India has received a major blow as the GST Council decided to impose a 28% tax on full face value of bets in online gaming, horse racing and casinos. The decision has sparked outrage and criticism from the industry players, who fear that the increased tax rate could kill the industry and drive away investors.

What is the GST Council’s decision?

The GST Council, which is the apex body for deciding tax rates and rules under the Goods and Services Tax (GST) regime, met on July 11, 2023, to discuss various issues related to the indirect tax system. Among the decisions taken by the council, one was to levy a 28% tax on full face value of bets in online gaming, horse racing and casinos.

This means that the online gaming companies will have to pay 28% tax on the entire amount wagered by the players, irrespective of whether they win or lose. For example, if a player bets Rs 100 on an online game, the company will have to pay Rs 28 as tax, even if the player loses the bet or wins a lesser amount.

The council also decided that there will be no distinction between skill-based and chance-based games for taxation purposes. This means that games like fantasy sports, rummy, poker, chess and quiz, which claim to be based on skill and not gambling, will also be taxed at 28%.

The council justified its decision by saying that online gaming, horse racing and casinos are “sin goods” and should be taxed at the highest rate. It also said that the decision was taken to curb tax evasion and bring uniformity in taxation across states.

How will the decision impact the online gaming industry?

The online gaming industry in India has expressed its disappointment and dismay over the GST Council’s decision. The industry players have said that the decision will have a detrimental impact on the industry’s growth, innovation and employment.

According to a report by KPMG India and Indian Federation of Sports Gaming (IFSG), the online gaming industry in India was valued at Rs 6,500 crore in 2020 and was expected to grow to Rs 18,700 crore by 2022. The industry also employed more than 40,000 people directly and indirectly.

However, with the 28% tax rate, the industry fears that it will lose its competitiveness and attractiveness for investors. The industry also argues that online gaming is not a sin good but a legitimate form of entertainment and skill development. The industry claims that it has proven its skill-based nature in various courts of law and has complied with all regulatory norms.

The industry also says that the decision will hurt the players’ interest as they will have to pay more tax or receive less winnings. The industry also warns that the decision could lead to an exodus of tech companies from India and encourage illegal and unregulated gaming platforms.

What are the reactions of the industry players?

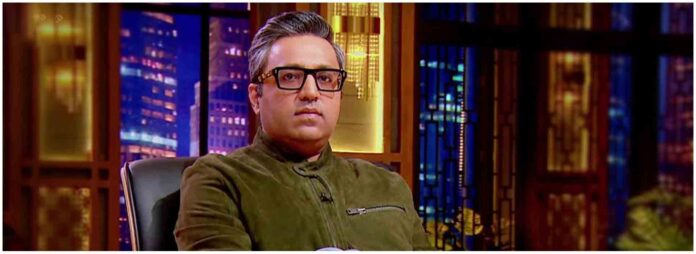

One of the most vocal critics of the GST Council’s decision is Ashneer Grover, co-founder of CrickPe, a cricket fantasy gaming platform. Grover took to Twitter to express his frustration and anger over the decision. He said that the government has killed the real money gaming industry in India and wasted $10 billion worth of potential.

He also said that it was time for startup founders to enter politics and be represented or else this would happen to every industry. He sarcastically said that he would love to see 28% GST and 20% TCS on land purchases as well.

Grover also questioned why celebrities like Virat Kohli and MS Dhoni endorsed online gaming platforms if they were sin goods. He said that online gaming was not gambling but a form of skill development and entertainment.

Other industry players like Nazara Technologies, Dream11, Games24x7, Paytm First Games and Mobile Premier League also expressed their disappointment over the GST Council’s decision. They said that they would seek legal recourse and engage with the government to reconsider its decision